Senate votes to increase top income tax rate

The Senate voted to increase income taxes on the state's wealthiest persons today. The plan would add a fourth tier to our income tax system, and would go away once our budget was in better order. Predictably, Republicans and the governor were all over it, calling it a "job-killer" and "the dumbest idea to come down the pike in years," according to Senator Bob Kierlin.

Is it? Is this a stupid idea, or is it warranted? Should the Carl Pohlads and Brian Sullivans of the world pay more in income taxes? Well, that's a hard question to answer without context, so I'm going to give you some.

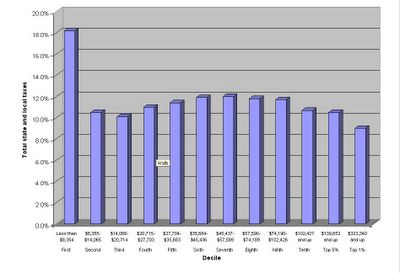

In order to figure out if income taxes should be increased, we need to know if these wealthy people are paying their fair share or not. Fortunately, it isn't hard to find out: the state of Minnesota does tax incidence studies every couple of years to find out exactly how much people are paying in state and local taxes as a percentage of their income. If you look at the most recent study, based on 2002 data, it is very revealing. You have to check a few tables to get all the number, but here's the bottom line in graphic form:

Tax rates

As you can see, our state's tax system looks like a camel: those of us in the middle pay the most as a percentage of income, while those at the bottom and top pay less (the first decile, consisting of teenagers working part time, college students, and similar people, is an outlier). Now, I have no problem with the poor paying less, since I believe in progressive taxation, but it certainly isn't fair that those at the top pay less. And as the numbers show, the higher your income, the less you pay.

So despite all the blathering from the governor and Republicans about this tax adjustment, all the Senate is doing is ensuring that the wealthy pay just as much as you or I. Is that wrong? Is that unfair? I don't think so.

0 Comments:

Post a Comment

<< Home