Taxes

Today a bunch of wealthy Minnesotans took out an ad saying that they think the state should raise taxes on them to pay for education, health care, and transportation improvements.

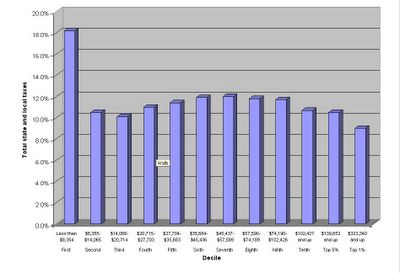

Should this happen? Are the wealthy not paying their fair share? Some time ago I had a post on this very issue, but the most important thing is the graph showing how taxes fall on various income groups:

Notice how the tax incidence hump peaks in the middle class and drops off for the very wealthy. So if anybody should be paying their fair share, guess who it should be?

4 Comments:

They can also donate their money to charity, and bypass the government. It would be more efficient to give money directly to local charities (soup kitchen, scholarship foundations), or even national ones such as the Salvation Army and Habitat for Humanity.

It's really easy--just write a check, or get it deduced from your paycheck via the United Way (just like the IRS does)! I do it, so can members of the think tank Growth and Justice.

I'm not sure there's a charity for improving transportation...

Anybody notice how, while the hump is in the middle, the spike is on the left? I'm having a hard time reading the numbers on the graph, but it appears that the poorest are bearing the greatest burden. Brilliant that those who can afford the least pay the most.

I'm not sure there's a charity for improving transportation...

There sure are. In my town, there are charities that operate shuttles for the elderly, handicapped and people who don't drive (www.paratransit.org). There are also charities that sponsor ride-sharing (www.erideshare.com), road maintenance and clean-up, and bridge maintanance.

So the Growth and Justice group have plenty of charities to work with, in virually every field imaginable!

Post a Comment

<< Home